An engineer interested in what technologies can do to improve and simplify people’s lives. Pragmatic. Client-focused.

This is how Ciprian Onofreiciuc describes himself.

But if you get the chance to talk to him longer, you’ll also discover the eyes of an artist in Ciprian, one who loves people, values creativity just as much as cutting-edge technology, and has a broad perspective on the engines that drive the world forward, contributing to its development himself.

An artist in programming solution architecture, part of the Connections team since 2021, and one of the members involved in the major projects of the moment.

After being involved in projects with top 5 companies in banking and telecom in Romania, in roles such as Senior Developer or solution architect, in December 2023, he made another leap toward clients from the public sector, transitioning from the role of consultant to that of implementer and integrator.

The Secret to Success: Contributor in Every Role in Business and Life

Ciprian’s work, alongside the other connectors at CC, is based on a few clear principles: he focuses on results; he continuously strengthens his knowledge and skills base, from which he periodically makes technological and informational leaps; in his relationships with others, he always seeks to honor his commitments, offering predictability and consistency.

Throughout his career, he has been involved in various teams, either as a leader, taking on shared decisions and responsibilities, or as an executor/consultant, following directions defined by other people in leadership roles.

“I enjoy blazing new trails, seeking out untapped opportunities, taking moderate risks, and accepting challenges in unknown and high-potential areas,” he says. “In my career and life, I have alternated between leadership and management roles and that of an individual contributor. In every scenario, it’s important to adapt and contribute as much as possible to a project.”

Digitalization, the dance where technology takes other fields by the hand

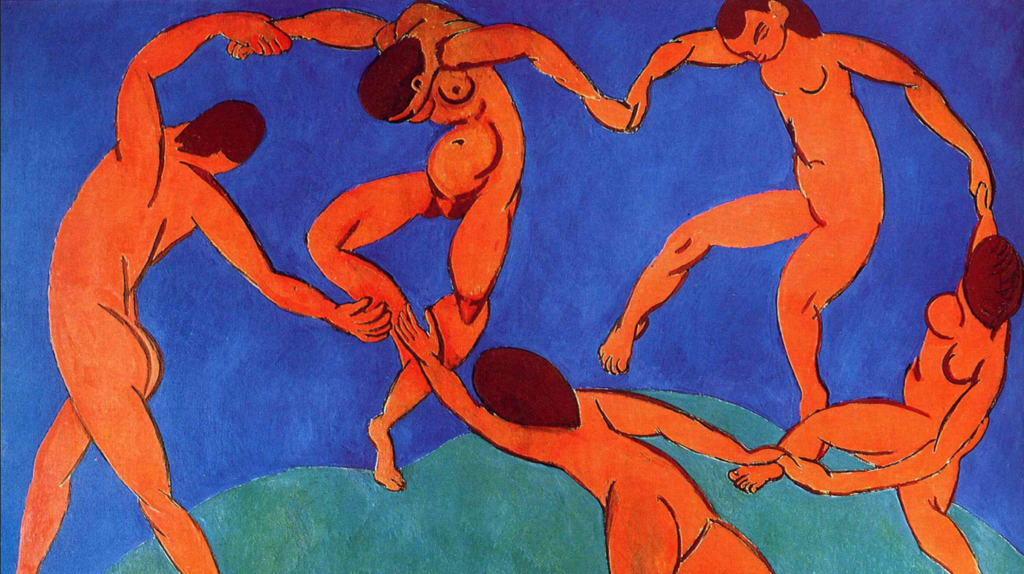

If anyone doubts that poetry and programming go hand in hand, and that it is built on a deep understanding of the world we live in, they must meet Ciprian. For him, digitalization looks like a memorable dance, where impactful fields move in sync, holding hands with technology, and passing on multiplied value.

“When I started, I believed that computer science, or what was called digitalization at the time, was only about programming, and I felt extremely proud to be a programmer—until I saw other equally complex and useful technological wonders.

Today, I see digitalization more as one of the dancers in Henri Matisse’s painting ‘The Dance’: it joins a dance you admire with wonder, making the dance possible together with other dancers, which for me represent other important fields in people’s lives. Digitalization must intertwine with other domains to offer the maximum benefits, and the more fields there are, the greater the impact and the more beautiful the dance.”

“The Dance” by Henri Matisse, 1910. Image sourced from HenriMatisse.org.

We cannot disdain ancient civilizations for being outdated

How does Ciprian personally relate to technology? It is made to help and support human activity, he reminds us, and from this perspective, he views with respect all the stages of development humanity has gone through. He knows a well-known secret, though less often discussed in public: at some point, every technology was considered spectacular before it eventually became commonplace.

“We cannot ignore or depreciatively evaluate a certain technology, just as we cannot disdain ancient civilizations for being outdated. Everything is built by integrating or improving upon previous technologies. Many times, we adopt and use technology without realizing it, and only its absence makes us aware of its importance.”

The industry’s challenge: what do we choose to become along with progress?

The greatest challenge Ciprian sees is undoubtedly tied to progress.“Performance issues seem the most interesting to me because that’s where technological limits arise. Solving these problems generates progress and creates technological leaps,” he says.

Consequently, the challenge he would pose to the IT industry is one that will undoubtedly spark long debates for years to come: Do you believe augmentative technological implants will bring progress and a better life for humanity?

“I believe that, in this entire evolutionary context, it’s important for people to be aware of natural human value. I’m sure the answer would be a resounding yes, but I’m not sure if humanity will remain the same with this progress.”

Message for a Beginner in IT: The Foundation is Everything!

For a junior just starting out in the industry, Ciprian has a fundamental piece of advice: Build a foundation, and then explore from there.

How can you do that?

“There are several ways to build this foundation,” he says. “You can do it theoretically, by accumulating knowledge in an academic way, followed by a certification aimed at achieving certain objectives; or practically, by participating in a project that follows specific industry standards and covers all stages of a product’s lifecycle.”

Simple, right? 🙂