Connections, a technology company listed on the AeRo market of the Bucharest Stock Exchange (symbol CC), announces the publication of its audited financial results for 2024, confirming a gross profit margin of 10%, the highest level since the company’s listing.

The group’s consolidated revenues amounted to 106 million RON, with a gross profit of 10.22 million RON and a net profit of 8.83 million RON.

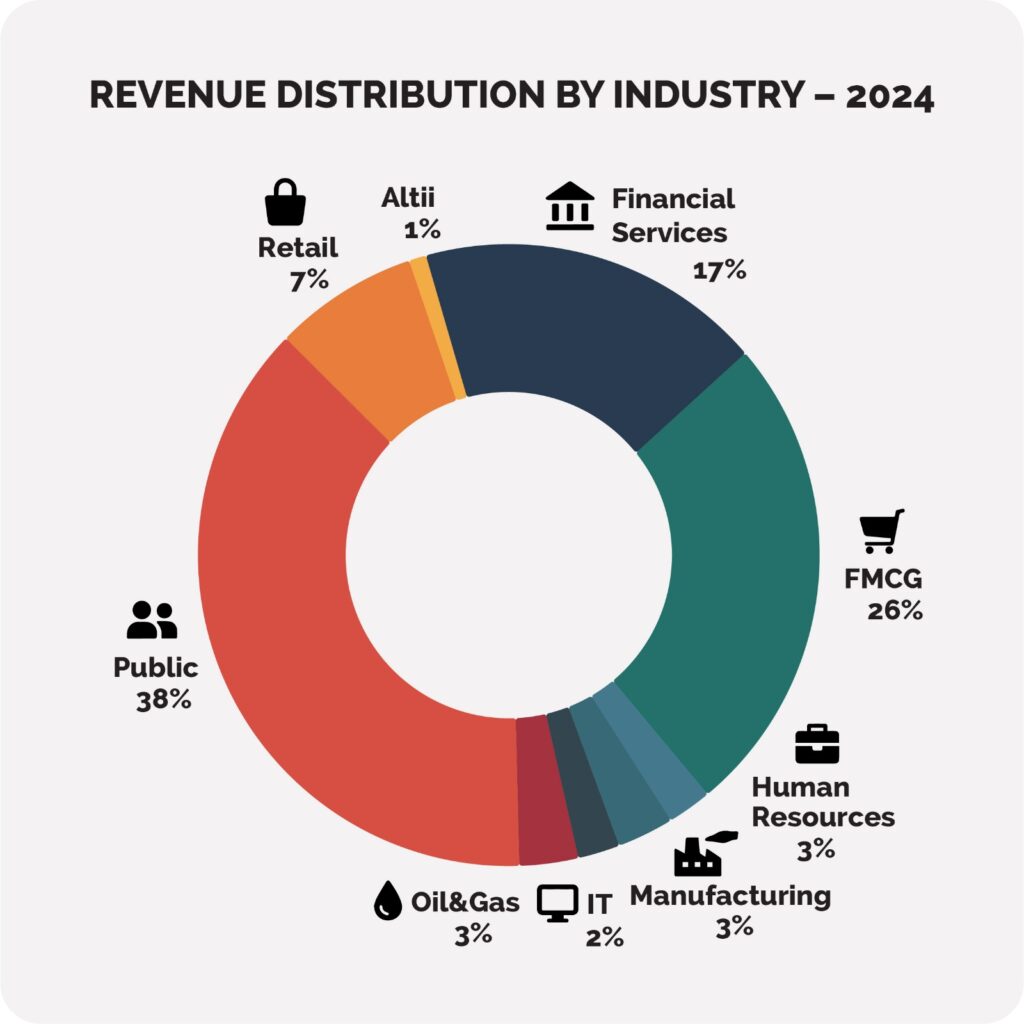

The company’s revenue structure highlights a well-balanced diversification across sectors, with 38% coming from the public sector, followed by FMCG (26%) and financial services (17%). This strategic approach significantly reduces the vulnerabilities associated with reliance on a single sector, thereby strengthening the company’s long-term resilience and adaptability in a dynamic economic environment.

“In 2024, we strengthened our position by increasing the share of the private sector in total revenue, thus confirming the transition to a more resilient and predictable business structure. We invested in artificial intelligence projects with significant public impact and, in partnership with two Romanian companies, are developing two innovative cybersecurity products with an investment of over 4 million RON. We managed to deliver strong performance in a complex year, and for 2025, we aim to increase revenue by expanding our client portfolio and leveraging the growing demand for our innovative solutions,” said Bogdan Florea, Founder and Co-CEO of Connections.

The year 2024 marked the delivery of a major AI project in the United Arab Emirates, based on Large Language Model (LLM) technology, aimed at increasing operational efficiency for clients by up to 15%. In parallel, the company completed the development of two proprietary cybersecurity products and strengthened its presence in the Middle Eastern and Central European markets.

“2024 was the year we tested our technological maturity and confirmed that we can deliver complex international projects. The delivery of the LLM-based AI system in the UAE is clear evidence of our technical capabilities and the trust we are building with each partnership. Beyond innovation, we have increased operational predictability and strengthened our internal infrastructure to support scaling in the coming years. In 2025, we are focused on expanding this successful trajectory, enhancing our international presence, and continuing to deliver innovative solutions in AI and cybersecurity, supporting sustainable financial growth and ongoing optimization of operational processes,” said Radu Marcu, Co-CEO of Connections.

PERSPECTIVES FOR 2025

For 2025, Connections aims for a sustainable 20% revenue growth, supported by the expansion of its enterprise client base and strong demand for solutions based on artificial intelligence, automation, and cybersecurity. This objective will be pursued with strict cost control and an estimated net margin of 9%.

With a planned gross margin of 12.4% for the current year, the company is strengthening its financial position, increasing its self-financing capacity, and creating solid foundations for recurring and predictable revenues.

The scaling strategy focuses on increasing volumes in profitable segments, consolidating its presence in international markets, and optimizing operational costs. Connections continues to invest in the development of proprietary cybersecurity products, explores strategic technology partnerships, and leverages its experience in large-scale regional projects.

The full report on Connections’ 2024 results can be accessed HERE.