Today, we are launching a series of analyses on Connections, a digital transformation company listed on the Bucharest Stock Exchange (BVB) under the symbol CC. This initiative aims to offer a clear and detailed overview of our rapidly expanding business.

Our goal is to consistently highlight the essential aspects of our operations, providing maximum clarity and an overall picture of the journey we are building day by day. For financial details, you can find us on BVB (CC), where we offer transparent and updated financial reports, or visit our website at https://connectionsconsult.ro/investitori-v2/

As part of our #ConnectionsCEOTalks series, we start with an intervii featuring Bogdan Florea, Co-CEO and founder of Connections. He provides insights into the developments of 2023 and our plans for the current year, exploring revenue growth in our business divisions, the strategic decisions impacting company growth, and the balance between local and international markets. We will also discuss ambitious profitability goals for the year ahead.

Let’s proceed to the interview with Bogdan to delve deeper into the company’s activities and future perspectives.

REVENUE DISTRIBUTION:

IT vs. non-IT, local vs. global

HOW DID 2023 LOOK FOR CONNECTIONS CONSULT? HOW DID THE COMPANY’S REVENUES EVOLVE BY BUSINESS DIVISIONS?

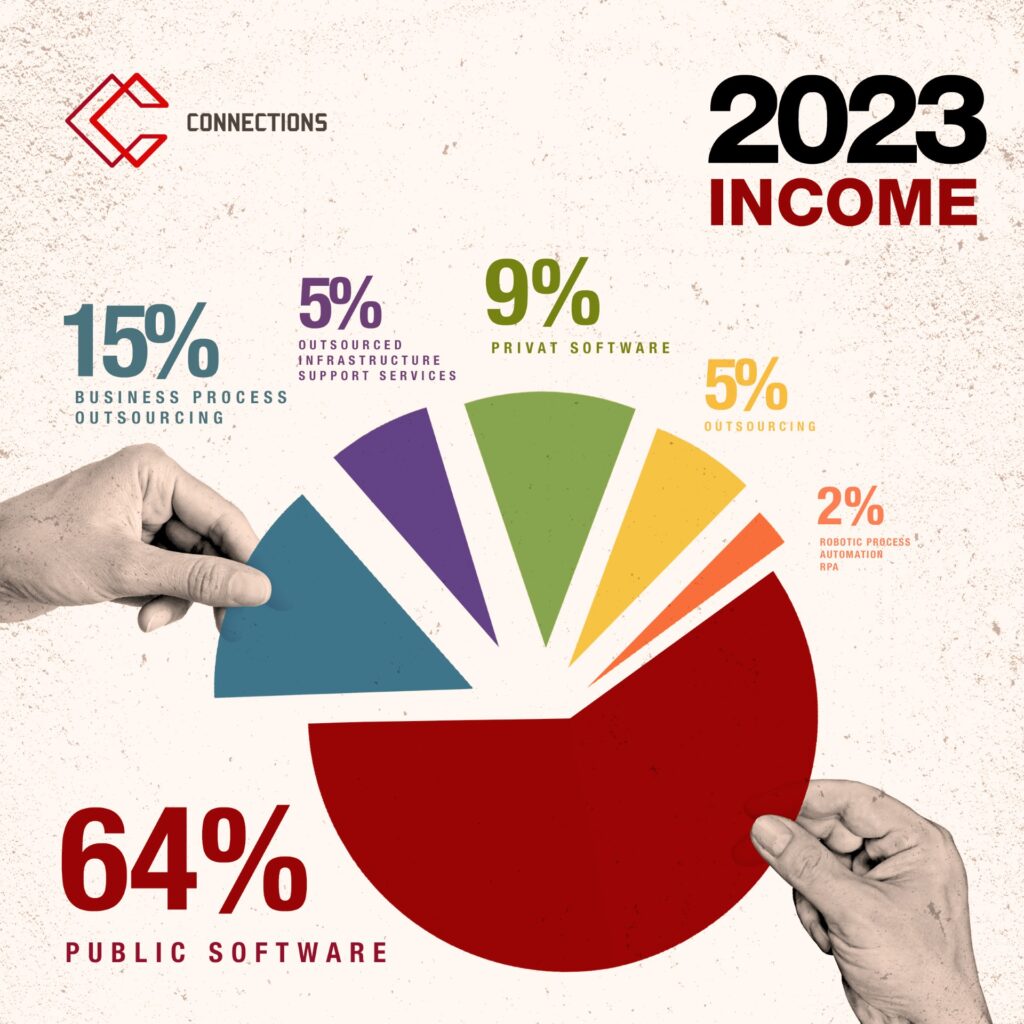

In 2023, we observed a shift in the balance between our business lines, driven primarily by accelerated revenue growth in the software development and digital transformation team, making this division the primary contributor to the group’s revenues. By the end of 2023, the revenue breakdown by business lines was as follows: the BPO division accounted for 15% of the group’s total revenues, IT outsourcing/IT support contributed 5%, combined private and public software accounted for over 70%, RPA (Robotic Process Automation) represented 2%, and technology outsourcing or consulting accounted for 5%.

Compared to 2022, we notice a difference, an increase, as mentioned, in the software development and digital transformation area, at the expense of the BPO division, which decreased from contributing 48% to total revenues to 15%. However, this decrease was only in terms of percentage of total revenues, as the absolute value of the BPO department’s figures remained the same as in 2022. This is due to the evident growth in the group’s revenues, a rapid increase in 2023, as we would say.

The revenues of all business lines, except for the digital transformation business unit, remained stable in 2023 compared to 2022, and we are pleased to observe a rapid growth in the digital transformation team from 2022 to 2023. So, we have stability across all lines and a very — I would say an impressive growth in the digital transformation area.

WAS THE GROWTH OF THE SOFTWARE DIVISION A STRATEGIC DECISION OR RATHER MARKET EVOLUTION?

The shift in revenue distribution within the group’s total revenues is the result of a strategy formulated around 2021, coinciding with our entry into the capital market (listing on the BVB). Its essence lies in our strong desire to migrate almost exclusively towards the technology sector.

Looking back to 2021, when we made the decision to list the company or group of companies, we also had a non-IT sector that was closely tied to technology, historically providing significant cash flow and opening doors to potential technology projects through cross-selling effects. Our goal was not only to maintain but also to significantly increase the group’s revenues, shifting predominantly towards technology and especially new technologies in the service portfolio offered to clients.

We achieved this by adding clients from the governmental and public sectors to the group’s portfolio, heavily relying on European funds. We all hope these funds will contribute to the digitalization of both central and local public administrations, along with the National Recovery and Resilience Plans (PNNR) obtained by all EU member states following the Covid pandemic. Through this blend of strategy and opportunities emerging in the public sector domain, we successfully shifted the revenue distribution, placing much more focus on the tech IT area.

FROM A GEOGRAPHICAL PERSPECTIVE – LOCAL VERSUS INTERNATIONAL MARKETS?

Historically, Connections has typically derived between 20% to 30% of its revenues from international markets, with some fluctuations up until 2022. However, starting in 2023, this percentage has seen a significant decline in terms of its share within the total revenue mix.

In absolute terms, our revenues from international markets have remained relatively stable or have shown slight growth. Yet, due to the rapid expansion of local revenues, the proportion of international revenues has diminished in the overall revenue composition of the group.

We remain dedicated to identifying new clients in international markets, actively pursuing relationships with foreign companies to enhance our overall revenue streams. At the same time, we are committed to nurturing our presence in the domestic market.

In economic theory and practical corporate management, there is a straightforward principle suggesting that international expansion becomes feasible when a company establishes a solid foundation in its domestic market. Expansion here entails not only establishing subsidiaries abroad but also effectively penetrating foreign markets.

Considering ourselves a medium-sized company, with potential aspirations to grow into a larger entity in the near future, we are encouraged by our robust stability in the domestic market. Strengthening our foothold in the domestic market presents promising opportunities for expanding exports in the near to medium term.

This perspective is compounded by current global economic indicators, unfortunately forecasting a downturn in the months or years ahead, alongside a prevailing trend towards localization of services.

We observe a nuanced philosophical underpinning derived from global political and geopolitical dynamics: companies are increasingly sourcing suppliers closer to delivery locations, which introduces certain barriers in engaging with foreign markets. However, technology remains a unifying factor in the global economy, where common language transcends cultural or national barriers. We maintain our interest in international revenues while concurrently focusing on serving our domestic market clients.

INCREASING PROFIT MARGIN: CONNECTIONS’ FOCUS FOR 2024

Regarding the profit margin, in 2023 we saw a slight increase in percentage terms as well as in absolute value. Due to revenue growth, we achieved significantly higher gross and net profit figures, but the percentage terms remain within the same range, around 8%. One of the major goals of the group is to achieve a double-digit gross profit margin, including EBITDA, and sustain it for the next 5 years, aiming for a gross profit margin of approximately 11-12%, certainly above 10%. For us, it’s important not only to quickly achieve this margin in a single year but also to sustain it reliably over the long term.

HOW WILL WE MOVE FROM A SINGLE-DIGIT PROFIT LEVEL TO DOUBLE DIGITS?

Unfortunately, there’s no magic solution; it requires a lot of hard work and a clear plan that the entire strategy and team must follow.

We can increase operational margin, but this is more challenging considering we are operating in an already stable market.

The main opportunity lies in optimizing expenses, focusing on delivering services much more efficiently. A project that previously took 3 months to achieve a certain result can be revised to be delivered in a shorter time frame while maintaining the same quality standards — this represents a significant internal improvement and enhances the professionalism we offer to our clients.

Additionally, we need to manage fixed expenses, where Connections is already performing well — fixed costs represent less than 10% of total revenues, which is considerably positive in my opinion. However, we will continue to monitor and control fixed costs to increase our operational margin and achieve our profitability goals for the entire group.

This is the major challenge for this year, and we must demonstrate how capable we are in managing these aspects.